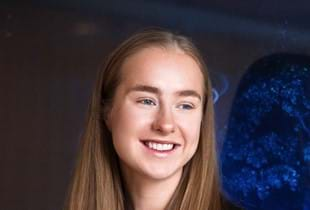

Fredrik Olsson

Fredrik Olsson

Fredrik is the Managing Partner of the Stockholm office.

Fredrik focuses on financing transactions and restructurings. He has vast experience of a wide range of finance related work, such as LBO’s, real estate financings, corporate lending and asset finance.

Fredrik is very clever in negotiations and makes sure the drafting of a certain point negotiated comes out to the client’s benefit.

Capital Markets | Client Choice, 2024

References

Counsel to Comstock Inc. in its investment in RenFuel, a Swedish innovation company in bioenergy. The investment aims to support commercialization of joint development applications for RenFuel and Comstock complementary renewable fuel technologies.

Fredrik Olsson

Albert Danielsson

Ebba Sjölin

Jonas Sjöberg

Nadine Lågland

Elin Boman

Elisabeth Vestin

Nicolas Günthardt

Josephine Gjerstad Medina

Nellie Jönsson

Counsel to Thoma Bravo in its growth investment in Hypergene.

Claes Kjellberg

Douglas Essehorn

Emma Andersson

Ulrika Wigart

Elin Boman

Aykut Aslan Yucel

Fredrik Olsson

Carolina H. Wahlby

Sofia Granberg

Caroline Sundberg

Nicolas Günthardt

Peter Forsberg

Sarah Ek

Josephine Gjerstad Medina

Nellie Jönsson

Angelica Berntsson

Parties:

KLAR Partners, Sandbäckens, Storskogen Group AB

Transaction:

KLAR Partners backed Sandbäckens has acquired EVIAB Gruppen AB, Växjö Elmontage AB, and El & Projektering Vetlanda AB, controlled by Storskogen Group AB.

Deal value:

Value not public

Role:

Counsel to KLAR / Sandbäckens

Claes Kjellberg

Miklos Kovacs Scherlin

Anna Nordin Pettersson

Ulrika Wigart

Klara Hasselberg

Fredrik Olsson

Carolina H. Wahlby

Rezan Akkurt

Johan Erlandsson

Josephine Gjerstad Medina

Abiram Soma

Angelica Berntsson

Sara Heikfolk

Peter Forsberg

Sarah Ek

Parties:

IK Small Cap III Fund, Responda Group

Transaction:

IK Small Cap III Fund’s investment in Responda Group

Deal Value:

Value not public

Role:

Counsel to IK Partners

Johanna Wärnberg

Miklos Kovacs Scherlin

Douglas Essehorn

Anna Nordin Pettersson

Ulrika Wigart

Fredrik Olsson

Albert Danielsson

Johan Erlandsson

Lisa Pålsson

Olof Östman

Parties

Aneo, Marguerite Infrastructure

Transaction

Aneo has acquired of two wind farms in Sweden

Deal value

Value not public

Role

Counsel to Aneo

Johanna Wärnberg

Douglas Essehorn

Alexander Lindqvist

Nadine Lågland

Emma Johari

Mikael Stabo

Andreas Wingren

Fredrik Olsson

Rezan Akkurt

Parties

KLAR Partners, Nimlas Group, Konstel

Transaction

Nimlas Group, a leading Nordic technical installation services platform, has acquired Konstel, a leading electrical installation company in Norway

Deal Value

Value not public

Role

Counsel to KLAR Partners / Nimlas Group

Claes Kjellberg

Fredrik Olsson

Miklos Kovacs Scherlin

Carolina H. Wahlby

Rezan Akkurt

Emma Andersson

Ulrika Wigart

Parties

PCP, Nordic Leisure Travel Group AB

Deal

Counsel to PCP in its EUR 60 million loan facility to Nordic Leisure Travel Group AB

Deal Value

EUR 60 million loan facility

Role

Counsel to PCP

Fredrik Olsson

Maria Orrgard

Ebba Sjölin

Albert Danielsson

Parties

PCP and Avia Pharma AB

Transaction

PCP in its SEK 350 million term loan to Avia Pharma AB

Deal Value

SEK 350 million term loan

Role

Counsel to PCP

Fredrik Olsson

Maria Orrgard

Ebba Sjölin

Josephine Gjerstad Medina

Parties:

Meko AB (publ)

Transaction

Counsel to Meko AB (publ) in its refinancing of existing financing agreements.

Deal Value

Meko AB's refinancing of SEK 1,965,000,000 term loans and amendment and restatement agreement of its revolving credit facility of SEK 1,300,000,000.

Role:

Counsel to Meko AB (publ)

Fredrik Olsson

Maria Orrgard

Rezan Akkurt

Parties:

PCP, Kry International AB

Transaction:

Counsel to PCP in their ESG-linked Debt Financing to Kry International AB

Deal Value:

Value not public

Role:

Counsel to PCP

Fredrik Olsson

Maria Orrgard

Oscar Bengtsson

Tanja Schnitt

Jenny Lundberg

Lisa Pålsson

Olof Östman

Lars Lundgren

Andreas Wingren

Parties:

Thomas H. Lee Partners, inriver AB

Transaction:

Counsel to Thomas H. Lee Partners in its investment in inriver AB

Deal Value:

Not public

Role:

Counsel to Thomas H. Lee Partners

Claes Kjellberg

Maja Uppgren

Tanja Schnitt

Nicolina Hultgren Farsani

Mattias Friberg

Khaled Talayhan

Fredrik Olsson

Carolina H. Wahlby

Maria Orrgard

Albert Danielsson

Oscar Bengtsson

Jenny Lundberg

Parties:

Vitec Software Group AB

Transaction:

Counsel to Vitec Software Group AB (publ) in its refinancing and extension of its loan facilities

Deal Value:

Not public

Role:

Counsel to Vitec Software Group AB

Fredrik Olsson

Maria Orrgard

Albert Danielsson

Parties

Gores Guggenheim, Inc., The Gores Group and Guggenheim Capital, LLC, and Polestar.

Transaction

Gores Guggenheim, Inc. in its closing of business combination with Polestar

Deal value

The transaction implies an equity value of approximately USD 20 billion for Polestar.

Role

Legal advisor to Gores Guggenheim, Inc. together with Weil, Gotshal & Manges LLP.

Richard Åkerman

Douglas Essehorn

Alexander Lindqvist

Josephine Gjerstad Medina

Lisa Pålsson

Fredrik Olsson

Andreas Wingren

Elisabeth Vestin

Anna Ribenfors

Parties:

KLAR Partners, Oleter Group, Swoosh

Transaction:

Counsel to KLAR Partners backed Oleter Group in the merger between its underground infrastructure maintenance business (UIM) and Swoosh

Deal Value:

Value not public

Role:

Counsel to KLAR Partners

Claes Kjellberg

Miklos Kovacs Scherlin

Emma Andersson

Tanja Schnitt

Anna Nordin Pettersson

Josephine Gjerstad Medina

Andreas Wingren

Fredrik Olsson

Carolina H. Wahlby

Amanda Alexandersson

Peter Forsberg

Lars Lundgren

Olof Östman

Parties

IK Small Cap III Fund (“IK”)(founders), Sitevision AB (“Sitevision”)

Transaction

Counsel to IK Partners in its Investment in Sitevision AB

Deal Value

Value not public

Role

Counsel to IK Partners

Johanna Wärnberg

Miklos Kovacs Scherlin

Douglas Essehorn

Nadine Lågland

Fredrik Olsson

Albert Danielsson

Oscar Bengtsson

Lisa Pålsson

Olof Östman

Ebba Sjölin

Jenny Lundberg

Andreas Wingren

Parties

PCP and Aarke

Transaction

Counsel to PCP in connection with its debt financing of Aarke, who provided a five-year senior secured loan facility to Aarke

Deal Value

Role

Counsel to PCP

Fredrik Olsson

Maria Orrgard

Amanda Alexandersson

Parties

Gores Guggenheim, Inc., Polestar

Transaction

Counsel to Gores Guggenheim, Inc., a special purpose acquisition company (SPAC) formed by the affiliates of The Gores Group and Guggenheim Capital, LLC, in its proposed business combination with the global electric performance car company Polestar.

Deal Value

Role

Counsel to Gores Guggenheim, Inc.

Richard Åkerman

Douglas Essehorn

Alexander Lindqvist

Elisabeth Vestin

Anna Ribenfors

Josephine Gjerstad Medina

Lisa Pålsson

Fredrik Olsson

Andreas Wingren

Parties

KLAR Partners Limited, Oleter Group consisting of OCAB and Frøiland Bygg Skade

Transaction

Counsel to KLAR Partners Limited in the Investment in Oleter Group

Deal Value

Value not public

Role

Counsel to KLAR Partners Limited

Claes Kjellberg

Miklos Kovacs Scherlin

Emma Andersson

Maria Orrgard

Fredrik Olsson

Josephine Gjerstad Medina

Sarah Ek

Parties

Holmström Fastigheter AB, Areim AB, Magnolia Bostad AB

Transaction

Counsel to consortium of F. Holmström Fastigheter AB and Areim AB on its public offer for Magnolia Bostad AB

Deal Value

The offer values Magnolia Bostad at approximately SEK 2,9 billion

Role

Counsel to consortium of F. Holmström Fastigheter AB and Areim AB

Ola Åhman

Mattias Friberg

Emma Greiff

Anton Eriksson

Fredrik Olsson

Peter Forsberg

Mikael Stabo

Alexander Lindqvist

Andreas Wingren

Sarah Ek

Parties

IK Investment Partners

Transaction

IK Investment Partners (“IK”) in its investment in Mecenat Holding AB

Deal Value

Value not public

Role

Counsel to IK Investment Partners

Johanna Wärnberg

Miklos Kovacs Scherlin

Douglas Essehorn

Jessica Tressfeldt

Fredrik Olsson

Albert Danielsson

Lisa Pålsson

Emma Andersson

Andreas Wingren

Parties

Proventus Capital Partners IV AB (publ), MatHem

Transaction

Proventus Capital Partners IV AB (publ) in its SEK 700 million loan facility to MatHem.

Deal Value

SEK 700 million loan facility

Role

Counsel to Proventus Capital Partners IV AB (publ)

Fredrik Olsson

Maria Orrgard

Jonas Sjöberg

Ebba Almén

Josephine Gjerstad Medina

Parties

Proventus Capital Partners IV AB (publ), Ovzon AB

Transaction

Proventus Capital Partners IV AB (publ) in the debt financing of the Ovzon-3 Satellite

Deal Value

USD 60 million

Role

Lead counsel to Proventus Capital Partners IV AB (publ)

Fredrik Olsson

Mattias Friberg

Maria Orrgard

Khaled Talayhan

Parties

KLAR Partners, Sandbäckens, Segulah

Transaction

KLAR Partners funds make first acquisition in Sweden: Acquire Sandbäckens to build the Nordic region's leading technical installation and property services Group

Deal Value

Value not public

Role

Counsel to KLAR Partners

Claes Kjellberg

Miklos Kovacs Scherlin

Ebba Almén

Emma Andersson

Fredrik Olsson

Rezan Akkurt

Martin Rifall

Jenny Lundberg

Josephine Gjerstad Medina

Parties

Savaria Corporation, Handicare Group AB

Transaction

Savaria Corporation in Its Public Offer for Handicare Group AB

Deal value

The offer values Handicare at approximately SEK 2.9 billion

Role

Counsel to Savaria Corporation

Mattias Friberg

Ola Åhman

Marc Tevell de Falck

Fredrik Olsson

Albert Danielsson

Peter Forsberg

Sarah Ek

Alexander Lindqvist

Jenny Lundberg

Parties

Paradigm Capital Value Fund SICAV, Internationella Engelska Skolan i Sverige Holdings II AB (“IES”)

Transaction

Counsel to consortium led by Paradigm Capital on its public offer for Internationella Engelska Skolan

Deal Value

The offer values IES at approximately 3.3 Billion

Role

Counsel to Consortium Led by Paradigm Capital

Mattias Friberg

Ola Åhman

Christoffer Saidac

Emma Greiff

Khaled Talayhan

Marc Tevell de Falck

Fredrik Olsson

Carolina H. Wahlby

Rezan Akkurt

Peter Forsberg

Parties

Vitec Software Group AB (publ)

Transaction

Vitec Software Group AB (publ) in its refinancing and extension of its loan facility

Value

Value not public

Role

Counsel to Vitec Software Group AB (publ)

Fredrik Olsson

Maria Orrgard

Rezan Akkurt

Parties

Magnesium Capital LLP, Rejlers Embriq AS, Rejlers Embriq AB, Rejlers AB (publ)

Transaction

Magnesium Capital LLP in the acquisition of Rejlers Embriq AS and Rejlers Embriq AB from Rejlers AB (publ). The acquisition was made by funds advised by Magnesium Capital LLP

Deal Value

Value not public

Role

Counsel to Magnesium Capital LLP

Claes Kjellberg

Ola Åhman

Fredrik Olsson

Johanna Wärnberg

Carolina H. Wahlby

Ebba Almén

Josephine Gjerstad Medina

Jonas Sjöberg

Alexander Lindqvist

Parties

CORDET, Creades, Instabox

Transaction

Counsel to CORDET in the secured financing transaction of Instabox.

Deal Value

Value not public

Role

Counsel to CORDET

Fredrik Olsson

Claes Kjellberg

Jonas Sjöberg

Maria Orrgard

Parties

IndraVia Capital Partners

Transaction

InfraVia Capital Partners in the financing of the construction and operation of BJV’s wind farm located in Sweden.

Deal Value

EUR 133 million

Role

Counsel to InfraVia Capital Partners

Fredrik Olsson

Maria Orrgard

Rezan Akkurt

Johanna Wärnberg

Douglas Essehorn

Parties

Polygon AB (publ)

Transaction

Polygon AB (publ) on its EUR 40 million subsequent bond issue

Deal Value

EUR 40 million

Role

Lead Counsel to Polygon AB (publ)

Fredrik Olsson

Carolina H. Wahlby

Mattias Friberg

Khaled Talayhan

Emma Greiff

Parties

Logent AB, Stirling Square Capital Partners LLP

Transaction

Logent Group issue of SEK 900 Million Senior Secured Notes and the Entry Into of a Super Senior RCF

Deal Value

SEK 900 million

Role

Counsel to Logent Group and SSCP

Fredrik Olsson

Carolina H. Wahlby

Mattias Friberg

Khaled Talayhan

Emma Greiff

Mikael Klang

Douglas Essehorn

Parties:

Transaction:

Deal value:

HS role:

Mattias Friberg

Fredrik Olsson

Carolina H. Wahlby

Khaled Talayhan

Emma Greiff

Parties

Ragn-Sellsföretagen AB

Transaction

Ragn-Sellsföretagen AB in its refinancing of its existing financing arrangements with various lenders, including long term financing of various projects in Sweden and abroad

Deal Value

Value not public

Role

Lead counsel to Ragn-Sellsföretagen AB

Fredrik Olsson

Albert Danielsson

Parties

Calabrio Sweden AB (Buyer), HoldIT Communication AB (Seller), Teleopti (Target)

Transaction

Calabrio, a portfolio company of KKR, in its acquisition of Teleopti, a global provider of cloud-based workforce management (WFM) software

Deal Value

Value not public

Role

Counsel to Calabrio

Claes Kjellberg

Fredrik Olsson

Jonas Sjöberg

Josephine Gjerstad Medina

Sara Heikfolk

Douglas Essehorn

Jenny Lundberg

Parties

Stirling Square Capital Partners LLP (Buyer), Logent Group (Target), Adelis Equity Partners (Sellers)

Transaction

Stirling Square Capital Partners LLP in the Acquisition of Logent Group from Adelis Equity Partners.

Deal Value

Value not public

Role

Counsel to Stirling Square Capital Partners LLP

Mikael Klang

Fredrik Olsson

Carolina H. Wahlby

Jessica Tressfeldt

Josephine Gjerstad Medina

Douglas Essehorn

Jenny Lundberg

Parties

Ahlstrom-Munksjö (Buyer), Expera Specialty Solutions (Target), KPS Capital Partners (Seller)

Transaction

Ahlstrom-Munksjö’s acquisition of Expera Specialty Solutions, a U.S.-based specialty paper producer

Deal Value

USD 615 million

Role

Counsel to Ahlstrom-Munksjö

Fredrik Olsson

Albert Danielsson

Carolina H. Wahlby

Parties

Counsel to Polygon AB (publ) and Triton

Transaction

Issue of a EUR 210 million rated senior secured bond and the entry into of a super senior RCF

Deal Value

EUR 210 million

Role

Counsel to Polygon AB (publ) and Triton

Fredrik Olsson

Carolina H. Wahlby

Parties

Alimak Group

Transaction

Alimak Group in connection with its rights issue of SEK 790 million

Deal Value

SEK 790 million

Role

Counsel to Alimak Group

Fredrik Olsson

Triton and Polygon on the tap issue of EUR 60,000,000 issued under the terms and conditions for the existing EUR 120,000,000 senior secured bonds issued in April 2014

Fredrik Olsson

Parties

Valedo, Prosero Security

Transaction

Valedo on the financing in its establishment of Prosero Security through investments in several Nordic companies.

Deal Value

Value not public

Role

Counsel to Valedo

Fredrik Olsson

Parties

Valedo (Buyer), BRP Systems (Target)

Transaction

Valedo's investment in BRP Systems

Deal Value

Value not public

Role

Counsel to Valedo

Fredrik Olsson

Parties

Intrum Justitia AB (Buyer) Lindorff (Target)

Transaction

Counsel to Intrum Justitia in Connection with the Combination with Lindorff

Deal Value

SEK 40 billion

Role

Counsel to Intrum Justitia AB

Fredrik Olsson

Richard Åkerman

Claes Kjellberg

Jenny Lundberg

Carolina H. Wahlby

Parties

Valedo Partners (Existing lead investor), General Atlantic (Investor), Joe & the Juice (Target)

Transaction

General Atlantic has made a strategic growth investment in Joe & the Juice to become the second largest shareholder in Joe & the Juice alongside existing lead investor Valedo Partners

Deal Value

Value not public

Role

Counsel to Valedo and other shareholders of Joe & the Juice

Fredrik Olsson

Peter Forsberg

Parties

Nordea, Technopolis

Transaction

Nordea on the financing of Technopolis’ expansion into Sweden

Deal Value

Value not public

Role

Counsel to Nordea

Fredrik Olsson

Parties

Valedo (Buyer), CMA Research AB and Markör Marknad & Kommunikation AB (Targets)

Transaction

Valedo's parallel acquisitions of CMA Research AB and Markör Marknad & Kommunikation AB

Deal Value

Value not public

Role

Counsel to Valedo

Fredrik Olsson

Parties

Adelis Equity Partners Fund I AB (Buyer), Sobro and minority shareholders (Seller), Nordomatic AB (Target)

Transaction

Financing of Adelis Equity Partners Fund I acquisition of the majority stake in Nordomatic AB

Deal Value

Value not public

Role

Counsel to Adelis Equity Partners Fund I AB

Fredrik Olsson

Peter Forsberg

Parties

Etib Holding (Buyer), Nordic Service Partners Holding AB (Target)

Transaction

Etib Holding has announced a recommended public offer to the shareholders and holders of convertible notes in Nordic Service Partners Holding AB (NSP) to all outstanding A- and B-shares in NSP, as well as convertible notes issued by the company.

Deal Value

Value not public

Role

Counsel to Etib Holding

Fredrik Olsson

Claes Kjellberg

Carolina H. Wahlby

Parties

Bridgepoint (Buyer), Nordic Cinema Group (Target), Ratos and Bonnier (Sellers)

Transaction

Bridgepoint on the financing of the acquisition of Nordic Cinema Group from Ratos and Bonnier

Deal Value

Value not public

Role

Counsel to Bridgepoint

Fredrik Olsson

Parties

Valedo

Transaction

Valedo on the acquisition financing of Norva 24

Deal Value

Value not public

Role

Counsel to Valedo

Fredrik Olsson

Parties

Triton, Alimak Group AB

Transaction

Triton and Alimak on its refinancing in connection with the IPO on Nasdaq Stockholm, 2015

Deal Value

Value not public

Role

Counsel to Triton and Alimak Group AB

Fredrik Olsson

Carolina H. Wahlby

Parties

Adelis Equity Partners (Buyer), INTERSPORT Sweden (Target)

Transaction

Adelis Equity Partners has agreed to acquire a 70% stake in INTERSPORT Sweden.

Deal Value

Value not public

Role

Counsel to Adelis Equity Partners

Fredrik Olsson

Peter Forsberg

Parties

Bridgepoint's acquisition of Nordic Cinema Group

Transaction

Bridgepoint's acquisition of Nordic Cinema Group from Ratos and Bonnier

Deal Value

SEK 4,700 million

Role

Counsel to Bridgepoint

Peter Forsberg

Fredrik Olsson

Rankings

- "Fredrik is extremely good.", Chambers Global 2024 and Chambers Europe, 2024

- Ranked as exclusive winner of the 2024 Client Choice Capital Markets category in Sweden. Clients have described Fredrik as follows: 'Fredrik Olsson has both excellent public market skills and corporate law skills.', 'Fredrik provided hands-on support for the management team in matters relating to financing work.', 'Fredrik is very clever in negotiations and makes sure the drafting of a certain point negotiated comes out to the client’s benefit.', 'Fredrik Olsson is always very responsive and eager to help.'

- Ranked as Hall of Fame, Banking & Finance and recommended in Capital Markets and Insolvency, Legal 500, 2023

- Ranked as exclusive winner of the 2022 Client Choice Capital Markets category in Sweden

- "Fredrik Olsson is always there when you need him the most and is quick to answer or find answers", "you never feel stupid in asking questions from Fredrik and can always get explanations that a non-legal educated person like me can understand", "Fredrik Olsson is patient, straightforward, and has a down-to-earth mentality that make him great to work with", "Fredrik is challenging and guiding but most of all very helpful in every situation", Capital Markets, Client Choice 2022

- Ranked as Highly regarded lawyer, Asset Finance, Banking and Real Estate Finance, IFLR1000, 2022

- Ranked as Hall of Fame, Banking & Finance and recommended in Capital Markets and Insolvency, Legal 500, 2022

- 'Clients say: "able to move things forward and find commercial middle grounds.", Banking and Finance, Chambers Global and Chambers Europe 2022

- Ranked among the 2021 Top Financing Lawyers in EMEA by MergerLinks, 2021

- Ranked as 2021 exclusive winner of Client Choice’s Capital Markets category in Sweden

- "Many lawyers are naturally skilled when it comes to legal issues, but where Fredrik really stands out is his ability to connect legal issues with financial and commercial considerations.", Capital Markets, Client Choice, 2021

- "Fredrik is in all aspects a very pleasant individual to work with, as he has a genuine interest and knowledge of understanding commercial issues and how those should be reflected and considered in a legal context.", Capital Markets, Client Choice, 2021

- "Fredrik has a very strong understanding of the financial markets with good insights about market trends as well as the potential pitfalls being identified from such trends.", Capital Markets, Client Choice, 2021

- "Fredrik has been an instrumental resource in negotiations and in making the right commercial decisions to get deals done with the right balance of counterparty satisfaction and the best possible outcome for us as Fredrik's client.", Capital Markets, Client Choice, 2021

- Ranked as Hall of Fame, Banking & Finance and recommended in Capital Markets, Legal 500, 2021

- 'One client describes him as "very skilled and experienced" and also highlights his commercial approach', Banking & Finance, Chambers Global and Chambers Europe, 2021

- Ranked as Leading individual, Banking & Finance, Legal 500, 2020

- 'Clients say: "Fredrik is very well established and well respected in the market."', Banking and Finance, Chambers Global and Chambers Europe 2020

- Ranked as Highly regarded lawyer, Asset Finance, Banking and Real Estate Finance, IFLR1000, 2020

- Ranked in Hall of Fame, Legal 500, 2019

- Ranked as Leading individual, Banking & Finance, Legal 500, 2019

- "Fredrik Olsson is noted by interviewees for his commercial mindset and proactive approach", Banking & Finance, Chambers Global, 2019

- Ranked as Highly regarded lawyer, Asset Finance, Banking and Real Estate Finance, IFLR1000, 2019. 'Clients appreciate that Fredrik Olsson is "proactive and commercial"

- Ranked as Leading individual and leads the Bank & Finance team in Stockholm, Legal 500, 2018

- Ranked as Hall of Fame in The Legal 500 EMEA - 2024 edition

- ''Fredrik Olsson is a highly regarded lawyer. Interviewees appreciate that Fredrik Olsson is "commercial, available at short notice and effective.", Chambers Global and Chambers Europe, 2018

- Ranked as Highly regarded lawyer, Banking, Asset Finance and Real Estate, IFLR1000, 2018

- Ranked as Leading lawyer, Banking & Finance and Real Estate, IFLR1000, 2017

- Ranked as Leading individual, Banking and Finance, Legal 500, 2017

- Ranked as Leading individual, Banking and Finance, Legal 500, 2016

- 'The "excellent" Fredrik Olsson regularly advises clients on matters such as acquisition transaction financing and the restructuring of existing loans. In the words of one client, "he is really very good, and his team is great as well.", Banking and Finance, Chambers Global and Chambers Europe, 2016

- 'Fredrik Olsson's portfolio encompasses real estate finance and asset-backed transactions. Clients enjoy working with him and value his "excellent knowledge of the law and commercial approach.", Banking & Finance, Chambers Global and Chambers Europe, 2015

Memberships and Positions of Trust

- Member of the Swedish Bar Association

Publications

Education and Professional Background

- Partner, Hannes Snellman, Stockholm, 2010

- Specialist Partner, Hannes Snellman, Stockholm, 2008

- Associate, Managing Associate, Linklaters, 2002 – 2008

- Analyst, KPMG Corporate Finance, Stockholm, 2000 – 2002

- Master of Laws, Lund University, 2000

- B.Sc. in Business Administration, Lund University, 2000