Anniina Järvinen

Partner | Helsinki@hannessnellman.com

The climate crisis and imperative social issues have brought about momentous structural and regulatory changes, lifting environmental, social and governance (“ESG”) strategy and decision-making to the top of every board agenda. The ever present focus on ESG is driving companies to increasingly take account of the effects of their operations on all stakeholders, from shareholders and investors to the environment, customers, suppliers, employees, and communities alike. At the same time, the integration of ESG and sustainability factors into corporate strategies can present unprecedented business opportunities.

Our cross-practice team of experienced lawyers can help your company identify and navigate the legal challenges and possibilities presented by ESG initiatives to meet the new regulatory compliance and stakeholder demands facing your business. We do so by working together with you and by focusing our efforts where they count the most.

We are here to help you succeed in sustainable business.

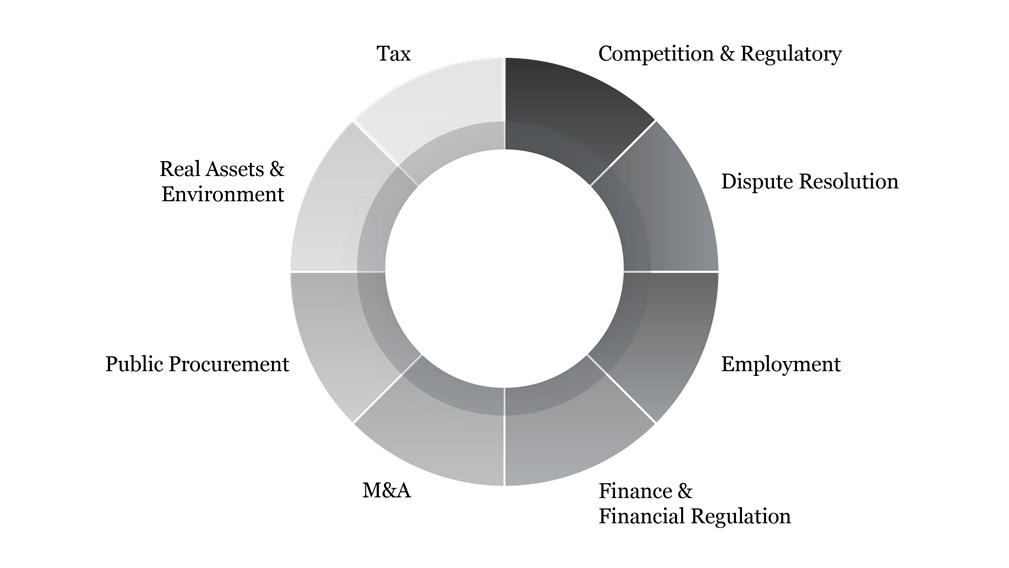

Our Competition & Regulatory Team supports our clients in various ESG-related matters. With a focus on competition law compliance, we provide our clients with the tools and best practices to incorporate a robust competition compliance framework throughout their organisation. Our services in this area include, for example, drafting and reviewing compliance policies and guidelines, as well as providing competition compliance training to personnel. We also assist our clients in ensuring that sustainability initiatives in their business operations comply with competition laws, by e.g. assessing standardisation agreements and other sustainability agreements between competitors. With our extensive experience in merger control and state aid matters, we also assist clients in handling e.g. climate, environmental protection and energy (CEEAG) state aid questions and in considering potential sustainability factors in merger control.

Hannes Snellman’s team of cross-practice compliance experts can guide you in all kinds of compliance issues, such as reporting channels, internal investigations, antitrust, privacy, corruption and bribery, sanctions and expert control, market abuse, and corporate governance. We provide insight into best practices, common challenges, legislative changes, and new developments and trends.

Our Dispute Resolution Team supports our clients in various ESG-related matters. With a focus on dispute prevention and dispute resolution, we advise our clients in relation to dispute resolution clauses in new types of contracts and assist them in investigating any ESG-related issues, whether related to internal governance, environmental, or social norms. In doing so, we work closely with other practice groups at Hannes Snellman. Should any ESG-related questions result in litigation before administrative or civil courts, our team will be there to assist our clients in setting a strategy for the case that takes into account both the legal and reputational risks, as well as litigating the case. We follow international case law closely and are happy to discuss developments with you.

Our Employment Team assists clients in complying with legislation and fulfilling requirements regarding equality and diversity at the workplace, physical and psychological health and safety, and various employment conditions (for instance, work environment, working hours, and remuneration). This includes providing concrete solutions for formulating clients’ values, setting sustainability targets, implementing practices, and drafting policies.

Valuing sustainable employment conditions does not only prevent negative legal consequences, but it also facilitates attracting and maintaining talent.

Our Finance Team advises clients across all aspects of sustainable finance, including green and sustainability-linked bonds and other ESG-related financing.

The Financial Services Regulatory team monitors and provides advice related to legal and regulatory ESG trends and developments in Finland and the EU. The team can advise clients on sustainable finance related legislation and ESG disclosures (including the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation).

Our M&A Team supports our clients in various ESG-related matters and advises boards of directors and senior management of both listed and non-listed companies in all matters having legal and strategic importance to the company. Our services include advising on corporate governance issues, securities market compliance, disclosure requirements and risk management, drafting of corporate governance policies and guidelines, and communication on legislative developments, such as the contemplated Corporate Sustainability Due Diligence Directive (CSDDD) of the EU. We advise in questions related to the responsibilities and due care of the board of directors and senior management, conduct transactional due diligence reviews, and assist in IPO and fund formation due diligence.

Our public procurement specialists assist in compliance analysis and legal assessments regarding the requirements, scoring criteria, and exclusion grounds. If needed, we also assist in drafting ways to mitigate existing exclusion criteria. This involves concrete solutions for the so-called self-cleaning and improvement of functions thereby avoiding exclusion from tendering competitions in the future.

Our Real Assets Team assists in various ESG and compliance related assignments in the areas of environment, projects and construction, energy, and real estate matters. We support our clients in ESG matters related to industrial, energy and green investment projects, including in particular questions concerning environmental liabilities, permitting and certifications, questions related to EU taxonomy, and management of ESG within supply chains and contractual networks. With regard to real estate and construction matters we assist in questions related to e.g. energy efficiency and carbon footprint of buildings, different certification matters (such as EPC, BREEAM). Our assignments typically involve regulatory investigations, advisory, commenting on technical ESG/EDD reports from a legal perspective, overall assessment of managing and flowing down ESG responsibilities across the supply chain, and providing concrete solutions relating to ESG within our field of expertise.

Our Tax Team supports our clients in ESG and compliance related assignments in the area of direct and indirect taxation. We help our clients to navigate and understand the emerging changes to the tax transparency, risk management, and governance landscape. Our assignments typically involve regulatory investigations and advisory for identifying tax incentives and risks relating to our clients’ businesses. We work closely with other practise groups in assignments having ESG dimensions, such as industrial, energy, and green investment projects, by offering tax advisory, structuring, and due diligence services. Our tax structuring and due diligence services are performed by taking into account good tax governance and other ESG aspects. In addition, we regularly assist our clients to seek for advance confirmations on the tax treatment of new business models from the Finnish Tax Administration. With our extensive experience, we also help our clients to align their tax strategy with broader corporate and risk management strategy.

Project development

Project finance

Ranked #1 for legal competence in the Energy & Infrastructure category by Prospera Law Firm Review 2023 in Finland.

ranked #2 for legal competence in the Environment & Natural Resources category by Prospera Law Firm Review 2023 in Finland.

Project development : Mining

Project development : Energy

"Professional and positive attitude."

"They have good market insight, clear arguments and they hold the contract structure together well."

"The firm has an outstanding, full-service energy and infrastructure practice with a professional, knowledgeable and very solution-focused team."

"Proactive, practical and take a business view in helping to conclude negotiations looking at what can be conceded and what protections should be retained."

"The firm has provided us with excellent advice on a very wide range of topics, from land lease agreements and permitting processes to financing and construction. The responses we get to our inquiries are accurate, understandable and based on solid experience."

Project development: Infrastructure

"Quick response time, high-quality work, wide areas of expertise, listens to the client's needs."

"Excellent knowledge of the construction law field, hands-on approach to managing contract content and negotiations with both excellent tracking of open issues and ability to make proposals to reach a balanced solution."